Blockchain

- Home

- Blockchain

Nirvista: The Unified Blockchain Finance Layer

Nirvista bridges TradFi and crypto with a single, regulation-ready financial layer: instant FX settlement, interoperable rails (CBDCs, stablecoins, major L1s), global POS & card acceptance, and one unified wallet that auto-converts to merchant fiat.

From instant remittances to fractional private-asset trading and embedded finance, Nirvista gives businesses and consumers a safer, faster, and more inclusive way to move and access capital.

Smart, Regulated, and Interoperable Financial Infrastructure

Nirvista combines programmable compliance, high-throughput settlement, and multi-asset liquidity to deliver enterprise-grade finance that moves at internet speed.

Power global commerce with rails that natively understand FX, regulation, and private-market assets.

-

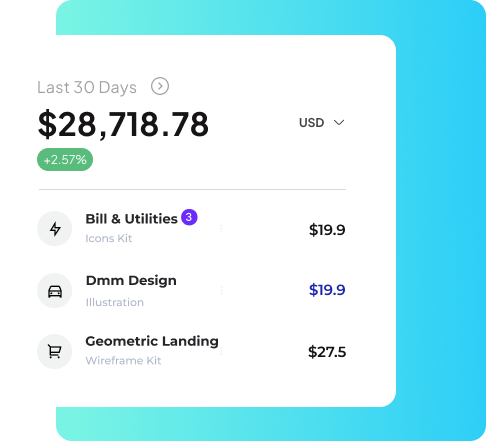

Instant FX and settlement — auto-convert at the point of sale so merchants receive local fiat immediately.

-

Interoperable rails & bridges — connect CBDCs, stablecoins, and major blockchains with unified liquidity pools.

-

Programmable compliance and auditability — KYC/AML, regulator dashboards, and on-chain policy enforcement.

Why Nirvista

Bridging What Blockchains Miss and What TradFi Needs

We built Nirvista to deliver the speed, reversibility, and regulatory controls of modern finance — plus the transparency, programmability, and inclusivity of blockchain.

Instant FX & Settlement

Local fiat to merchant in seconds — automatic conversion and settlement removes FX friction at POS and online checkout.

Interoperable Low-Cost Transfers

Route payments across CBDCs, stablecoins, banks, and major L1/L2s to find the fastest, cheapest path — with built-in compliance.

Fractional Private Markets

Tradable fractional exposure to private equity, pre-IPO shares, real estate and other non-listed assets with compliant custody and secondary markets.

Embedded Finance & On-Demand Capital

Integrated financing, instant working capital, and programmable payouts — embedded directly into merchant platforms and marketplaces.

Programmable Compliance & Real-Time Taxation

Nirvista embeds compliance into the protocol — real-time tax allocation, KYC/AML enforcement, and regulator-friendly audit trails so businesses can scale internationally without compliance friction.

Keep each transaction transparent, auditable, and settlement-ready.

Smart Dispute Resolution & Reversible Flows

We combine escrow, on-chain evidence, and a hybrid arbitration model to enable reversible and fair dispute outcomes — bringing chargeback-style protections to digital-native rails while preserving settlement finality where required.

Trust and recoverability built into the payment lifecycle.

Seamless Wallet & Rail Integrations

Link to global wallets, card networks, banks, CBDCs, and stablecoins — Nirvista's integration layer ensures smooth liquidity, fallbacks to card rails when needed, and instant conversion to merchant currency.

Accept payments everywhere, settle everywhere.

Want to Build the Future of Finance With Us?

At Nirvista, we're not just building products — we're architecting a new financial layer that makes cross-border commerce instant, compliant, and accessible to everyone.

Join us if you want to design rails that connect CBDCs, banks, blockchains, wallets, and private markets.