We help businesses integrate robust digital finance capabilities through flexible APIs, real-time data insights, and seamless user journeys — all backed by enterprise-grade security and innovation.

USED BY THE WORLD'S MOST INNOVATIVE COMPANIES

From embedded finance and API banking to smart wallets and payment automation, Nirvista delivers secure and scalable tools that help businesses build, launch, and grow with confidence.

DISCOVER POWERFUL FEATURES FOR BUSINESS-DRIVEN FINTECH SUCCESS

Integrate digital wallets, payments, and settlements directly into your platform with Nirvista’s API-first infrastructure.

Automate reconciliation, manage float, and track cash flow in real time with intelligent financial operations modules.

Access a plug-and-play suite of APIs for KYC, onboarding, payouts, invoicing, and transaction insights — all in one place.

Enable fast, secure, and real-time mobile transactions through Nirvista’s APIs — designed to support high-volume B2B and B2C payment flows globally.

Launch branded digital wallets that support multiple currencies, crypto tokens, and secure peer-to-peer transactions — fully customizable to your business model.

Offer embedded online banking features such as virtual accounts, linked cards, IBAN generation, and automated transaction analytics — powered by Nirvista’s backend stack.

We help businesses integrate robust digital finance capabilities through flexible APIs, real-time data insights, and seamless user journeys — all backed by enterprise-grade security and innovation.

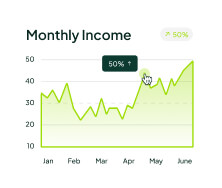

Real-time transaction snapshots powered by Nirvista's smart finance engine.

7-Day Activity

Cumulative Cashflow

Monitor revenue flows, automate reconciliation, and forecast growth — all through a unified financial operations dashboard.

Send and receive cross-border payments with real-time FX rates, local compliance handling, and zero delays.

Launch your own branded digital banking products with Nirvista’s plug-and-play BaaS infrastructure — virtual accounts, cards, KYC, and more.

Set up your fintech stack in minutes. From account creation to live transactions, our platform is built for seamless onboarding and scale-ready deployment.

Sign up and configure your business profile to unlock access to Nirvista's API-first financial ecosystem.

Complete secure verification using KYC & KYB flows tailored for global compliance and onboarding speed.

Start building and testing with live APIs for payouts, virtual accounts, cards, and embedded payments.

Enable real-time mobile money experiences, including instant transfers and wallet-to-bank settlements.

Embedded finance allows non-financial businesses to integrate financial services into their platforms. With Nirvista, you can offer digital wallets, real-time payments, and revenue financing directly to your users.

All wallet transactions are encrypted using industry-standard protocols, including multi-layer authentication, biometric verification, and real-time fraud detection powered by AI.

Yes, our API-first architecture allows seamless integration with popular ERP, CRM, and eCommerce platforms. We provide dedicated onboarding support to help you connect everything easily.

Bank-as-a-Service is a model where fintech platforms like Nirvista provide core banking capabilities—such as issuing cards, managing ledgers, or handling compliance—through APIs for other businesses to use.

Absolutely. Nirvista enables global payments in 50+ currencies with competitive FX rates and instant settlement. Our infrastructure is designed for borderless business transactions.

We adhere to global financial regulations including KYC, AML, GDPR, and PCI-DSS. Our legal team also provides jurisdiction-specific guidance to keep your business protected and audit-ready.